Incentive Programs: Moving the Other 80%

David G. Smith | The Reward Systems Group

Ironically, the managers responsible for sales incentive programs often find themselves a little demotivated.

They look forward to putting together rule structures about as much as they look forward to stripping wallpaper.

They are tired of spending time and energy to deliver the same results: their top 20% will likely do well and earn something, with only a few bright spots occurring below the top 20% level. And those people were probably working on some big deal that would have happened anyway…incentive or no incentive.

All in all it’s not a very happy picture, for either managers or participants. In the end, it’s tempting to measure the program’s success more on compliance to budget than on the sales lift or ROI. It’s tempting but not satisfactory. From what we see, companies are increasingly less willing to take the effectiveness of large incentive budgets on faith.

This widespread dissatisfaction argues for three major improvements in the area of program design: 1) an approach that consistently taps the “bottom 80%” for significant revenue increases, 2) a system that clearly measures incremental sales and margin gains, and 3) a “tune-able” design that can be improved with each future program so that every new program isn’t a laboratory experiment.

The good news:

The good news:

BI WORLDWIDE’s patented GoalQuest® incentive system elegantly addresses these three critical needs.

Why the 80/20 principle is almost 100% unreliable.

In the early 1900s, the Italian economist Vilfredo Pareto proposed that 80% of society’s wealth was controlled by 20% of the population. Much to the detriment of incentive program design, this specialized assertion somehow morphed into the assumption that 80% of sales are made by 20% of the sales force.

As a result, we have seen too many companies cutting the bottom 80% out of any real chance to earn—or out of any incentive to increase sales results.

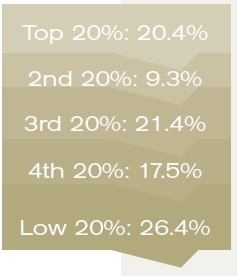

The facts simply don’t support any reliance on the 80/20 rule. In a 2010 study using sales results gathered during non-incentive periods from 150 companies and more than 50,000 salespeople, we found only one instance of an 80/20 distribution of sales.

Moreover, the average distribution was a surprising 80/46. In short, 80% of sales were coming from the top 46% of the sales forces. Any incentive program aimed primarily at the top 20% would dis-incent over half of the top producers!

Moreover, the average distribution was a surprising 80/46. In short, 80% of sales were coming from the top 46% of the sales forces. Any incentive program aimed primarily at the top 20% would dis-incent over half of the top producers!

This new understanding has clear implications for incentive design: it pays to engage performance levels from top to bottom and create lift from every sector of the performance bell curve. But that can rarely be done with the same set of rules applying to your top Reps and your new hires as well.

The GoalQuest design process addresses the issue by employing two key techniques: audience segmentation and baseline-related goals.

Design your next program with a hockey stick.

Audience segmentation is your starting point.

Take a sales volume report from your most recent quarter and sort it from highest results to lowest; then graph the results using Excel. At BI WORLDWIDE, we do this exercise eighty to one hundred times a year and find that the resulting curve has the same shape regardless of the industry or product involved.

It looks like a hockey stick laying on edge, doesn’t it? Analyzing the shape and slope of the stack-ranked curve leads to suggested segmentation points along the curve. Using these points as dividers, we segment the audience into groups of participants with similar sales results. This step allows us to create program goals that make motivational sense for all participants within the grouping.

Typically we create three to five sales segments in the analysis. Once the audience is segmented we are able to move to goal design with the knowledge that every Rep will have a chance to earn if he or she can improve results.

Typically we create three to five sales segments in the analysis. Once the audience is segmented we are able to move to goal design with the knowledge that every Rep will have a chance to earn if he or she can improve results.

Even after you’ve segmented, sales results may still vary between participants within the segments to the degree that some inequities or dis-incentives still remain. We address these differences by using individual baseline-defined goals.

Ideally, any participant’s program baseline (personal run rate) represents the results he or she would achieve during the upcoming incentive period if there were no incentive program in place. Since we’re talking about a future period, there is no exact measure available. Using the most-similar period actual results, adjusted up or down as necessary to account for market changes and trends, we apply the group’s goals to each participant’s personal baseline.

Quota is usually not the best baseline. For instance, let’s say you have 50 salespeople averaging over 130% of quota year to date. It wouldn’t make sense to consider sales between 100% and 129% of quota to be incremental, would it?

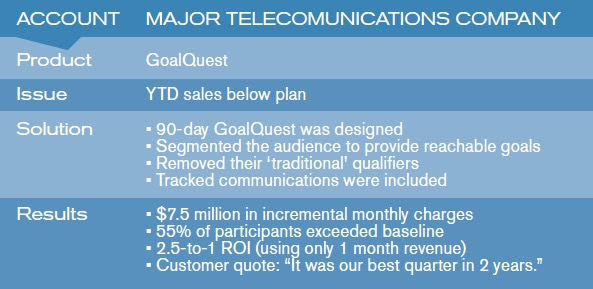

Program results support the processes.

An impressive 550 programs have confirmed the effectiveness of this process. Here are some observations from analysis of those programs:

Likewise, for the sales reps averaging 80% of quota, if they can increase to 95% for the quarter, doesn’t that indicate an increase in performance?

By segmenting the sales force into groups and then adjusting personal baselines, you predispose everyone from top dog to rookie to believe: 1) these goals require increased results, but I think I can attain one of the levels, 2) the awards being offered are attractive to me, and 3) I’m motivated to select a personal goal and charge ahead to reach it. When every participant has this same reaction you have maximized the engagement and opportunity for lift.

- Motivation is widespread. Over 56% of the GoalQuest participants to date (670,000) have improved results over their baseline expectation.

- Engagement reaches the bottom tiers of performers. Over 26% of the sales lift was produced by the lowest 20% of the audience and almost 44% by the lowest 40%.

- Incentive dollars were well spent across the board. Absolute dollar sales lift (above baseline) produced by the bottom 20% averaged 95% of the dollar lift produced by the top 20%.

- Participants are engaged enough to act. Over 96% of eligible direct sales people visited the program website and selected an individual goal for the program.

- Participants will stretch. Over 42% of goal selectors selected the highest goal offered.

All goals are set above an individual’s baseline (run rate).

Measurable results.

Of course, you will want to measure your own program.

The adjusted personal baselines you created when you designed the program will help you measure ROI.

The adjusted personal baselines you created when you designed the program will help you measure ROI.

Just subtract individual baselines from individual results and you can readily add up the incremental lift. Subtract awards and communications costs and do the math to calculate ROI.

An obvious question arises in relation to those participants whose sales were below baseline. Did the presence of an incentive program cause them to purposely do worse? We consider below-baseline results something that would have occurred with or without the program.

It’s also possible that, even though below-baseline performers did poorly, they may have attempted to succeed because of the incentive program and may have actually done better because of that extra effort. If so, the incentive program actually created some hidden (but not readily measurable) incremental sales.

Turning program design to increase results.

Once a GoalQuest program has been completed, it’s tempting to move on to something novel in the interest of appealing to distracted salespeople. To do so tosses out a valuable model for future programs.

Starting from scratch transforms every new set of program rules into a laboratory experiment. If you need to get the attention of salespeople in our 200 email-per-day world, change your theme or boldly communicate your program refinements. And by building on past successes and providing an easily understood way to acquire rewards, you are doing more to appeal to your sales force than any program-of-the-month ever could.

Because GoalQuest, unlike most other incentive structures, requires each participant to visit the website and “opt in” by selecting a personal goal, it helps them understand the rules and reduces confusion if the core rules structure is kept intact and repeated.

So, if the core structure doesn’t change, how is GoalQuest “tuned” for different results? The most basic tuning is to review performance results from a completed program and adjust the segmentation points and goal levels.

Segmentation points will normally change due to the increased performance in the earlier program.

The higher-performing A & B groups will increase as the C & D players move up the results ladder.

The designer’s goal is to move as many people into the next-higher group as possible. While there will continue to be A-B-C-D groups, participants should migrate to higher levels and be expected to deliver increased results.

After realignment of the segments, it’s time to look at the three goal levels offered to each group. Evaluate the market situation, timing and past performance in order to come up with reasonable stretch expectations. As discussed above, we believe that while annual goals are important, it is more effective to start with what the participants can accomplish in a shorter period of time.

After realignment of the segments, it’s time to look at the three goal levels offered to each group. Evaluate the market situation, timing and past performance in order to come up with reasonable stretch expectations. As discussed above, we believe that while annual goals are important, it is more effective to start with what the participants can accomplish in a shorter period of time.

Once you’ve readjusted segments and goals,you can refresh the core program by driving specific behaviors. If, for instance, a manufacturer offers both standard and deluxe product lines (with higher margins), a bonus might be offered to those who achieve their goals if X% of their sales are of the deluxe products.

If the program goal is to maximize sales, consider a post-achievement accelerator. We find that, within any group or segment of salespeople, there are those who can achieve and continue selling beyond goal attainment if motivated. Please note: The selected goal must be achieved before the participant is eligible for the bonus. This keeps the main program metric squarely in focus.

To maximize results, create a “4th performance level” which cannot be selected as a goal but which can be reached with a resulting bonus payment. In general, the award value at this 4th reward level needs to be at least a 20% premium because of the difficulty of reaching the higher performance level. In actual programs we have seen the illusory 4th level contribute significant sales increases beyond normal goals and improve the ROI of the overall program.

Measurements to avoid.

Measurement cannot be an afterthought. The wrong measure or metric can demotivate participants and negatively impact results.

For example, using assigned quotas as baselines and requiring a minimum of 100% performance to earn will rarely result in reasonable stretch goals unless 90% of your sales team is within 5-10% of quota year to date.

If the company expectation is that no one can earn an award unless they produce 100% of quota for the period, then only about 1/3 of the sales force is going to feel that the goals are reachable and you’re back to an underperforming design.

It’s fine to use quotas as a basis for segmenting the audience into groups. It’s even okay to use them as the basis for goal definition (e.g. Goal 1 is to achieve 80% of quarterly plan). But avoid imposing unrealistic sales gains on sales people who are below quota. It makes them indignant about the program and nets the company zero incremental gain.

The other measurement to be wary of is the qualifier. We have nothing against qualifiers that are reached regularly by the bulk of the sales force. The qualifiers that tend to demotivate require the participant to stretch in two directions at once…like increasing sales AND selling margin at the same time. If you want to increase both, and who doesn’t, the more effective way is to say, “If you hit your sales goal you’ll win ‘X’, and if you can also increase margins we’ll double the award!”

The other measurement to be wary of is the qualifier. We have nothing against qualifiers that are reached regularly by the bulk of the sales force. The qualifiers that tend to demotivate require the participant to stretch in two directions at once…like increasing sales AND selling margin at the same time. If you want to increase both, and who doesn’t, the more effective way is to say, “If you hit your sales goal you’ll win ‘X’, and if you can also increase margins we’ll double the award!”

The carrot always works better and more broadly than the stick. The excitement of believing you can reach a goal fades instantly if you don’t feel you can also meet the related goal or qualifier.

The Bottom Line on Design.

You do not have to settle for incentives as usual. Programs can stretch your top performers and engage your under-achievers.

Goals can be meaningful. ROI can be measurable. Maximizing results requires the proper mixture of relevant rewards, relevant communication and relevant baselines.

GoalQuest provides flexibility and does it in a way that allows complete results measurement and pre-program estimating.

If you’re a manager charged with motivating performance, we hope you’re recharged by this proven new approach. We know we are.

The best way to get started is to get in touch